GST, Seva Kendra is a Government’s Initiative to help India get access to understand GST and easily file GST-Complaints.

GST SEVA KENDRA:

CBEC initiated the GST Seva Kendra in the year 2017, February. GST Seva Kendra is one such facilitation center that tends to the needs of businesses, taxpayers and even those who are considering and preparing for the GST Registration. It was an important strategy initiated for the businesses and taxpayers to understand and have information on GST.

NEED FOR GST SEVA KENDRA:

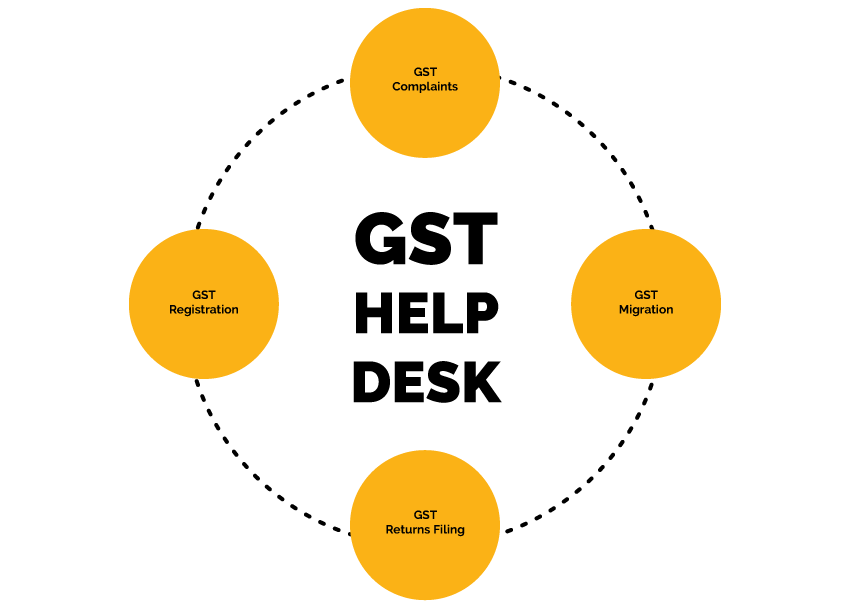

GST Seva Kendra is needed to ward off the old tax regime that exists from Post – Independence period. The main objective of GST Seva Kendra is to indoctrinate and prepare the citizens, tax-payers and businesses to switch from the old tax regime to follow the newly reformed GST – Goods and Services Tax – regime. As India is progressing for a PAN Indian GST registration, the Seva Kendra, the Facilitation Centre, or the GST Help Desk is ready to hear about GST Complaints, GST – Related queries that includes queries like GST Registration, GST Migration and GST Return Filing.

SERVICES OFFERED AT A GST SEVA KENDRA:

GST Seva Kendra, or the GST Help Desk, established by the CBEC, is bound by the task of guiding the GST – Registered taxpayer with GST – Complaints, GST – Related policies and GST Return Filing. The GST officers at the Seva Kendra are responsible for answering all the queries that the GST – Registered taxpayer. The officers at the Facilitation Center make sure that all the queries are resolved, all the GST – Complaints are registered and the taxpayers leave the office with all the questions answered.

WHY TO TRUST “GST SEVA KENDRA” INITIATIVE:

Although pursuing and guiding GST Taxpayers and businesses through the switching process, the trade facilitation measure is committed in assisting the taxpayers and businesses in GSTR Filing. An initiation that will pave way for India to have a unified market as this initiative helps in removing an array of taxes that were levied on taxpayer’s pre – GST period.

A seamless migration to GST for every Taxpayer is the main motto of the GST Seva Kendra. In other words, “GST Seva Kendra” directs the taxpayers to switch to GST in the quickest and most convenient way; easy registration for GST and precise GST Return Filing experience.

DETECTING GST SEVA KENDRA

The Central Board of Excise and Customs (CBEC) has made available over 8,000 GST Seva Kendra offices in every district across India. The offices are situated based on the range and the division of the district. The taxpayer, therefore, can connect with the nearest GST Seva Kendra according to the authority of their area. The number of these offices in these cities is very reassuring. For instance, the major cities like – Delhi, Kolkata, Mumbai and Bengaluru – have 202, 194, 178 and 50 GST Help Desk respectively. Whereas, other major cities like –, Pune, Chennai, Hyderabad, and Ahmedabad have 40, 55, 70 and 59 offices, respectively. These cities account for GST Complaints, and queries related to GST Registration and GST Returns Filing. These Kendras have made sure that the GST-registered taxpayer and business have their GST-related queries answered.

GST Complaints, Information on GST Registrations and GST Filing Returns is now accessible according to your convenience, all you need to do is to contact your nearest GST Seva Kendra through GST Helpline number for your area.

MyGSTzone.com is a company on a mission to conduct hassle-free GST Registrations and make them accessible to you without any complexity. All you need to do is leave all your GST worries to us. From registering to filing returns – GSTR-1, GSTR-2 and GSTR-3 – we take care of it. From helping to find your GST Seva Kendra to registering your GST – Complaints, we are there for you. All you need to do is to Contact us now on myGSTzone.com!!!