Introduction of GST

With the introduction of GST, it has become extremely important for taxpayers to comply with the new laws and regulations and adapt themselves with new business environment. Complexity in GST have increased quite a lot with day-to-day amendments, circulars & notification and therefore it is important for the taxpayers to work within the circle of law and to comply with all the rules and regulations and do proper tax planning.

Meaning of GST Reconciliation

Reconciliation in accounting term means to compare balances between two different set of accounts, balances and transaction. It involves comparing balances between two set of accounts or books, finding the difference and resolving it. Reconciliation is a time-consuming activity. It may look easier but with large chunk of data it becomes quite difficult to reconcile difference.

GST Reconciliation

GST Reconciliation is the comparison of Tax payable to government, Input Tax Credit (ITC) availed, Tax paid, Refund Claimed, etc between books of accounts as maintained by the organisation and the amount that is reported to Government via GST Returns i.e., GSTR3B, GSTR1, GSTR2A etc. In simple terms it means matching of Sales data and Purchase data of books of accounts with that of GST Return.

Why it is necessary to prepare GST Reconciliation??

It may happen due to various reason that amount reported in GST Portal does not match with amount recorded in books of accounts. Also, all the invoices uploaded by the taxpayers are interlinked with each other and it becomes easy for the GST authorities to track any figures misreported or not reported. Therefore, to avoid future litigations it is important for taxpayers to prepare GST Reconciliation and If there are multiple shops or branches then preparation of GST Reconciliation becomes extremely important as data gets more complex. Let us see the importance of GST Reconciliation below: –

Importance of GST Reconciliation

None of the taxpayers would like to pay interest for claiming excess ITC or suffer loss for not claiming ITC. Therefore, it is very important for GST Reconciliation to be 100% accurate. Vendor wise GST Reconciliation can also be prepared. Some of the reason about importance of preparing GST Reconciliation are given below: –

- As per rules, ITC can be claimed upto the date of filing annual return or due date of filing GSTR3B of September. Hence, GST Reconciliation will help taxpayers to identify and claim ITC that have not been claimed earlier.

- As per sec sec 50(1) if any person has taken excess ITC, they will have to pay interest @ 18% pa in addition to penalty that can be imposed by the GST authorities.

Therefore, it is very important to claim 100% ITC as none of the taxpayers will be willing to pay interest and penalty and neither they will want to claim less ITC. Also, it is important to reconcile differences as any difference between returns and books of accounts can lead to scrutiny notice by department and if taxpayers are unable to give satisfactory answer it may lead to further investigation by GST officer and in worst-case scenario cancellation of registration. While preparing GST Reconciliation. taxpayers may find many mismatches in the GST Return and books of accounts. Some of the reasons of mismatch are given below: –

Reason for Mismatch

There can be various reasons for mismatch of amount reported in GST Portal and amount recorded in books of accounts. Some of the reasons are listed below: –

- It may happen that vendors have not uploaded invoices in GST Portal or invoices uploaded by the vendors does not match with the amount recorded in books of accounts.

- Amount wrongly recorded in books of accounts due to clerical error

- ITC of blocked input taken by taxpayers.

- Invoices entered twice

- Mismatch in credit note/debit note

- Inter State transaction reported as Intra State or Intra State transaction reported as Inter State

How to do GST Reconciliation?

Following reconciliations are needed to be done while preparing GST Reconciliations: –

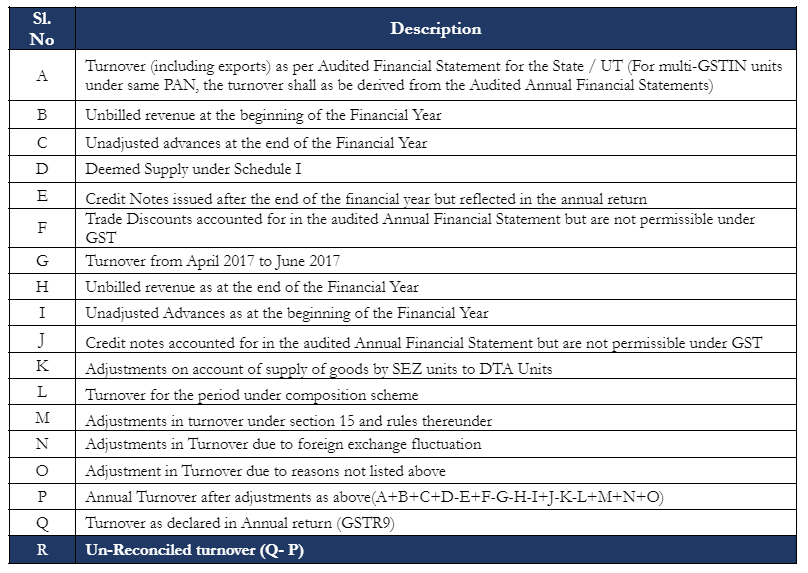

- Reconciliation of Taxable Turnover: –

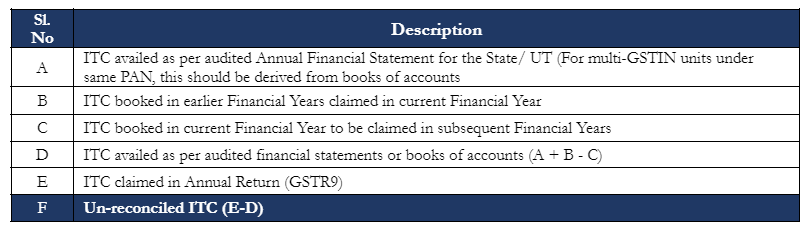

2. Reconciliation of Input Tax Credit

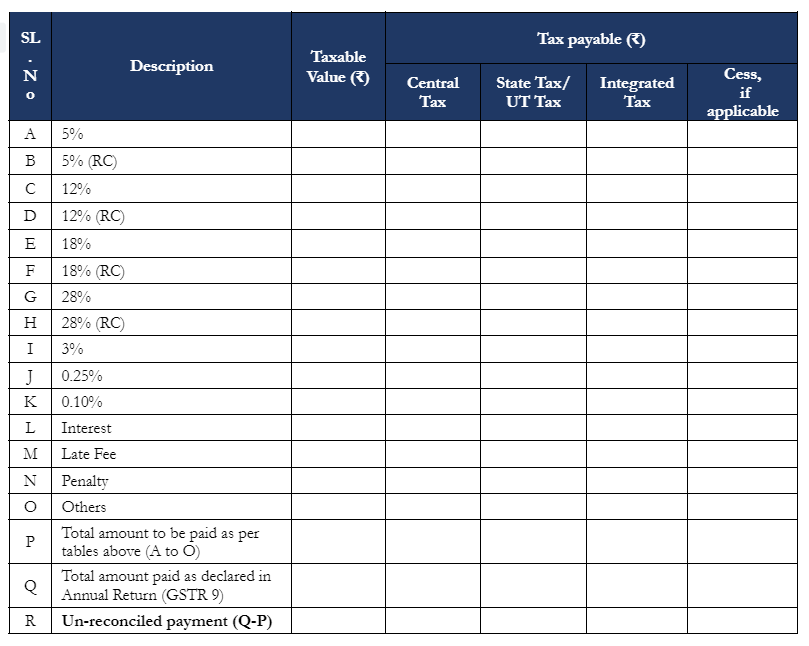

3. Reconciliation of Tax Paid (IGST, CGST & SGST separately & Tax Liability)

GST Reconciliation involves: -

- Monthly Comparison of sales figures recorded in GSTR1 vs GSTR3B vs Books of Accounts

- Monthly Comparison of ITC taken in GSTR3B vs Books of Accounts

- Monthly Comparison of ITC in GSTR3B vs GSTR2A

Conclusion

GST Reconciliation is time consuming and complex process and large amount of data increases the complexity of the transactions. Although, many online tools and softwares are available to make the process easy but it requires lots of human time and professional knowledge. It is mandatory to prepare GST Reconciliation for taxpayers whose turnover exceeds 5 Crore but it is always advisable that GST Reconciliation should be prepared by all the taxpayers to make sure that 100% accurate input has been taken and tax liability has been computed correctly because “Precaution is better than Cure” and government is not going to spare anyone who has taken excess ITC or paid less taxes.