Table of Contents

ToggleGET A NEW GST NUMBER FOR JUST Rs. 1500

GST Registration – let’s apply for a new GST Number for your business today!

Table of Contents

GST REGISTRATION ONLINE

Thanks to the introduction of GST (Goods and Services Tax) in July 2017, you can now apply and get a GST Registration online. You don’t need to go to a government office and fill out some paperwork to get a new GST Number.

Prior to July 2017, the government had VAT and Service Tax. The registration process then was cumbersome and took a long time. Not anymore. It’s much simpler to get a GST Registration today.

GST REGISTRATION PROCESS

Like we have mentioned before, the GST Registration process is completely online. There are no papers to be submitted physically at a government office like how it used to be before.

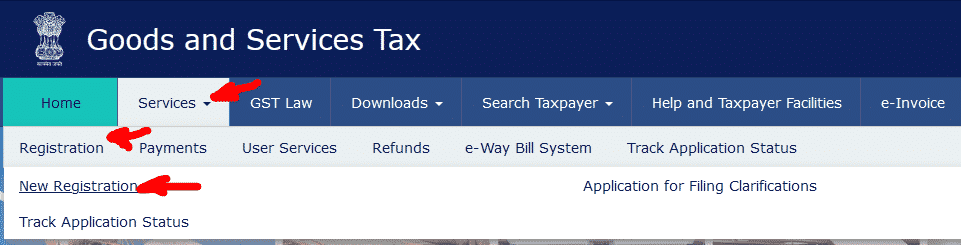

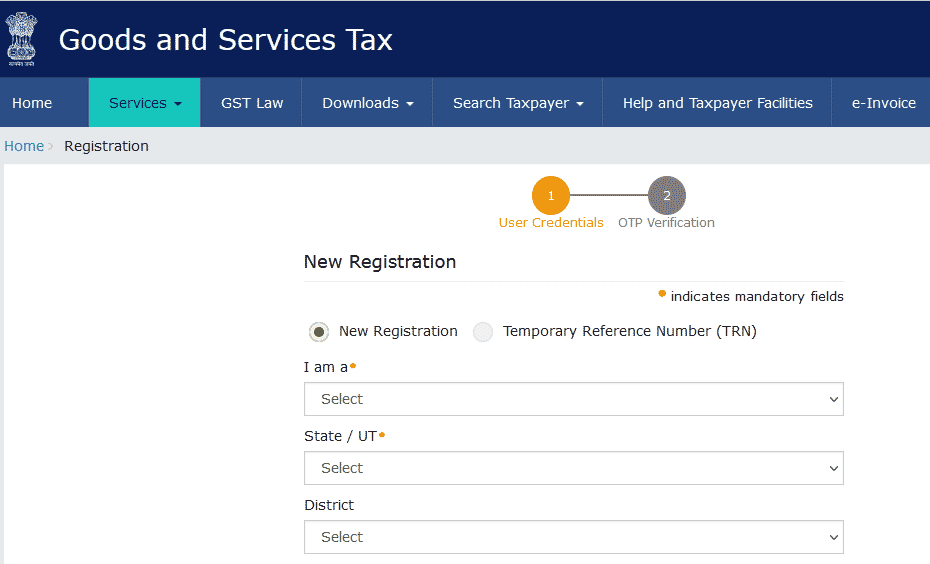

The GST registration process starts with collecting a few documents that are needed to apply on the government’s GST portal which is https://www.gst.gov.in/.

You will be then required to create an account on the GST Portal and then enter all the necessary details and upload the necessary documents required.

Don’t worry too much about the GST Registration Process. Continue reading further. We will be covering all the details and documents that are required to get a GST Registration.

The GST Registration process is pretty much the same regardless of the legal status of your business, i.e. whether your business is a sole proprietorship, a partnership, a limited liability partnership or a private limited company. However, depending on the legal status of your business, the documents required to complete the GST registration will vary.

In short, the GST Registration process is the same, but the documents required will vary.

GST REGISTRATION FOR A SOLE PROPRIETORSHIP

Most businesses in India are run by sole proprietors. These are individual business owners and their business is called a sole proprietorship or just a proprietorship.

Let’s take a look at the details and documents required to get a GST registration for a sole proprietorship.

Details Required For GST Registration For A Proprietorship

- Valid email address of the proprietor

- Valid mobile number of the proprietor

- Name of the business

- Top 5 Products or Services you sell

- Office Address Type – own property or rented property?

- Complete Office address with pincode

Documents Required For GST Registration For A Proprietorship

- PAN card of the proprietor

- Aadhaar card of the proprietor

- Passport-size photograph of the proprietor

- Documents of office address:

If OWN Property

– Electricity Bill and Property Tax Receipt in owner’s name

If RENTED property

– Rental agreement

– Electricity Bill or Property Tax Receipt in owner’s name

GST REGISTRATION FOR A PARTNERSHIP FIRM

These are the details and documents that are required for getting a GST Registration in the name of a partnership firm:

Details Required For GST Registration For A Partnership firm

- Valid email address of all partners

- Valid mobile numbers of all partners

- Name of the Partnership Firm

- Top 5 Products or Services you sell

- Office address: own property? Or rented property?

Documents Required For GST Registration For A Partnership Firm

- Partnership Agreement

- PAN card of all partners

- PAN card of the Partnership Firm

- Aadhaar card of all partners

- Passport-size photograph of all partners

- Board resolution – Required

- Documents of Office Address:

If OWN Property

– Electricity Bill and Property Tax Receipt in owner’s name

If RENTED property

– Rental agreement

– Electricity Bill or Property Tax Receipt in owner’s name

GST REGISTRATION FOR A PRIVATE LIMITED COMPANY

Let’s look at the details and documents that are required to apply for a GST Registration for a Private Limited Company.

Details Required For GST Registration For A Private Limited Company

- Valid email address of all directors

- Valid mobile numbers of all directors

- Name of the Private Limited Company

- Top 5 products or services you sell

- Registered office address: Own property or rented property?

Documents Required For GST Registration For A Private Limited Company

- Certificate of incorporation

- PAN card of all directors

- Company PAN card

- Aadhaar card of all directors

- Passport-size photograph of all directors

- Board resolution

- Valid Digital Signature

- Documents of Office Address:

If OWN Property

– Electricity Bill and Property Tax Receipt in owner’s name

If RENTED property

– Rental agreement

– Electricity Bill or Property Tax Receipt in owner’s name

GST REGISTRATION TIMELINE: HOW LONG DOES IT TAKE TO GET A GST NUMBER?

After you fill in the necessary details and upload the necessary documents in your GST Application, you get an acknowledgement number called the ARN. The ARN is proof that your GST Registration application has been submitted.

Once the ARN is generated, it will take the government around 15 working days to approve or reject your GST Application. If the GST Yes, it is possible to get a GST Registration in 1 day. However, we do not want to make any false promises. No one can guarantee that you will get your GST Registration completed in 1 day. It all depends on the information and documents that you have submitted in your GST Application and also depends on the officer who is assigned to approve your GST Application.

Please keep in mind that it may take 15 working days to even a month sometimes to get your GST Number after you have submitted your GST Application.

GST REGISTRATION IN ONE DAY – Is it possible?

Yes, it is possible to get a GST Registration in 1 day. However, we do not want to make any false promises. No one can guarantee that you will get your GST Registration completed in 1 day. It all depends on the information and documents that you have submitted in your GST Application and also depends on the officer who is assigned to approve your GST Application.

Please keep in mind that it may take 15 working days to even a month sometimes to get your GST Number after you have submitted your GST Application.

FREQUENTLY ASKED QUESTIONS ABOUT GST REGISTRATION

Once your tax consultant has applied for a GST Number on the government’s GST portal, he will get an acknowledgement number also called the ARN number. Please ask for the ARN number. This will ensure that your GST application has been filed.

After a GST Registration application is submitted, it gets assigned to a tax officer who verifies all the information and documents you submitted. If he finds that all the information and documents are correct, he may approve the application right away. If he feels that he needs some more information, he may send your application back seeking clarification.

Once a GST Application has been sent back for clarification, you will get 7 days to provide the clarification. The clarification could be to get some additional information from you or additional documents.

After a GST Registration application is submitted, it gets assigned to a GST officer to verify the information and documents that you had submitted in your application. In some cases, the GST officers will come to the business address that you have entered in the application to inspect the premises. The business address that you have mentioned is also known as the Principal Place of Business (PPOB). They usually will call you prior to coming. If they come, please do not panic. They might just ask a few questions regarding your business and leave. Please ensure you have your trade name that you have mentioned in your GST Application displayed outside your office address. This could be a simple printout or even a banner with your trade name that you have mentioned in your GST Application. We have seen officers rejecting GST Registration applications because the trade name was not displayed outside the office address.

In some cases, there will be no inspection by GST officers to approve your GST Application.

After a GST Registration application has been submitted, it takes about 15 working days to get a GST Number. However, sometimes you might get the GST Registration certificate in just one day. Sometimes it takes long – even a month to get your GST Number. It all depends on the information and documents that you have submitted in your GST Registration application and on the officer to whom your application gets assigned.

Before we answer this question, let’s try to understand why you would need multiple GST Numbers with one PAN number. This scenario usually arises when you are running multiple businesses and want to keep all GST numbers different for each business.

As far as we know, you may apply for as many GST Numbers you want with one PAN number. However, you need to ensure that you are filing the GST returns for each of the GST numbers regularly. Otherwise, you will not be able to get a new GST number.