Table of Contents

ToggleBusiness Valuation

What is Business Valuation? Definition, Methods, and Reasons

A business valuation is a process through which equity analysts and economists determine the economic worth of a business. Generally, the business valuation is conducted for many reasons, such as mergers and acquisitions, tax filings, divorce proceedings, or the establishment of ownership equity.

Business owners seek the help of professional business consultants or a CA firm to determine the correct worth of their business. In this brief and detailed article, we’ll walk you through the different methods of business valuation, why business valuation is usually performed, and how often should a business owner conduct a valuation of the business.

All businesses share the one common goal to generate the maximum profits for the shareholders. Even though timeframes, business strategies, marketing techniques, financial reporting or auditing might differ, the goal remains the same.

All business valuations are mere estimates. The objective behind the valuation and the status of the evaluator tends to influence the result.

For instance, accountants value a corporate entity for tax filing, so they are more likely to overestimate the business worth for tax savings. On the other hand, investment bankers will strive to justify the highest possible value.

While valuing a company, you should not confuse valuation with pricing. From the business standpoint, they both are completely different terms. The valuation reflects the actual financial performance of a company.

On the other hand, pricing emanates from supply and demand. It considers certain influencers such as investors’ perceptions about a specific business or industry, market rumors, and an overall economic situation.

Fundamentals of Business Valuation

The topic of business valuation is widely discussed in corporate finance. Typically, business owners conduct valuations when they intend to merge with another business or acquire an existing business with a steady cash flow and promising future growth.

Furthermore, business valuation is crucial when owners want to dilute their equities to receive a fair price that they can use to execute expansion plans.

A typical business valuation process involves analyzing business management, expected revenue growth, long-term or short-term liabilities, business growth plans, and the current worth of its long-term or short-term assets.

Not all business evaluators or accountants use the same tools for business valuation. Common approaches for business valuation include tracking financial statements, the sum of part valuation, dividend discount model, P/E, P/B, or comparing the company under review with its competitors working in the same industry.

Why Would You Need to Perform a Business Valuation?

Due to a lot of accounting involved in the business valuation process, valuing a business is a painstakingly tedious process. No business owners would like to evaluate a company regularly for these reasons. Therein the question arises.

Why would anyone need to evaluate a business? Here are some practical reasons for that:

Merger and Acquisitions or For Financing of Growth Plans

You are unlikely to make your business eligible for sale, purchase, equity dilutions, and merger and acquisitions with valuations.

Lenders and creditors both require an accurate company valuation before putting their money. Apart from that, valuation is turned out to be an effective tool for employee stock ownership plans (ESOP).

Litigation

Valuations are imperative for a divorce proceeding, establishing ownership equity, and resolving all the disputes amongst the business partners in public or private limited companies.

Tax and Succession Planning

Valuations play a decisive role in the determination of gift tax liabilities. Besides, tax and succession valuations adhere to the IRS guidelines.

Strategic Planning

A thorough analysis of business enables the company owners to identify the factors that stimulate growth and the structural impediments in their industry.

Pre-Money and Post-Money Valuations

Here is a quick overview of post-money and pre-money valuation methods and the differences between them.

Pre-Money

Simply speaking, pre-money valuation represents a financial figure that describes the overall financial health of a company ahead of any capital investment. Pre-money valuation is influenced by a business’s financials, such as assets, liabilities, revenue, net income, and a few other pertinent indicators of a company’s financial health.

Additionally, during the analysis evaluator thoroughly analyzes the company’s business plan, marketing strategy, competitors, topline and bottom-line growth, and all the exogenous factors that will ultimately influence the company’s ability to grow and flourish.

Thus, the pre-money valuation process emphasizes the company’s financial standing ahead of raising money via debt or equity.

Post-Money Valuations

In post-money valuation, evaluators look at the value of business subsequent to the influx of capital due to fundraising. With a post-money valuation, an investor’s decision of how much to invest in a certain company is heavily influenced by a post-money valuation.

It is worth mentioning that the pre-money valuation amount is also included in that offer. The value of the shares ahead of the investment can be easily determined by dividing the pre-money valuation by the total number of outstanding shares.

However, new shares have to be issued to raise more money from investors. Eventually, the total number of outstanding shares will go up, diluting an existing shareholder’s stake in the business.

To keep that in perspective, let’s take a real-life example. Suppose that XYZ company issue 1000 shares worth $20 each, and investors offer $10000. The investor will get 500 shares ($10000/20) in this scenario. As a result, there will be 15000 outstanding shares of that company in which the promoter has 1000 shares and an individual investor owns 500 shares.

It implies that the promoter’s stake in the original business will be reduced from 100% to 67%. However, if the company performs beyond the expectations and more money comes into the business down the line, the value of the shares will certainly increase. Likewise, the post-money valuation will also increase.

Thus, despite owning a small stake in a business, investors will enjoy a huge valuation for their shares.

How Frequently Should You Do Business Valuation?

A business valuation should be performed during the different phases of business existence for several reasons. The most prominent of them are impending IPO, new investment decisions, or a business exit strategy.

Since the business valuation requires seeking the help of a professional CA firm or a seasoned business analyst, the process could be costly and time-consuming. In most cases, the time and cost involved in the business valuation process thwart the businesses from undergoing a regular valuation.

However, the economic climate highly influences the financial status of a company. That’s why many companies deem annual valuation analysis appropriate.

Even though there is no straightforward rule on how frequently business valuation should be performed, here are a few tips to consider:

Very Rarely or Never

For smaller companies who do not want to raise capital for their businesses or liquidate all their assets at some point, they can perform the valuation process altogether. Although this approach might seem impractical, some entrepreneurs are quite possessive in their hard-won creation, so the approach bodes well for them.

However, if a company doesn’t intend to raise capital to finance its aggressive growth plans, it could assist in determining the company’s valuation for shoring up its profitability. As a result, evaluating a business’s economic value every time or after every five years might be worth considering.

Every One to Two Years

A myriad of companies engage in large-scale investments, raise capital via equity or debt capital regularly, or participate in any other activities that stimulate the need for business valuation. In all these cases, the valuation could be conducted every two to three years or as needed.

Conducting a seasonal valuation might be sufficient for some companies. Because the economic landscape keeps changing with time, most valuations are only valid for a few years.

On a Regular Basis

Valuation of economic business worth frequently is commonly observed in the large-scale companies involved in large-scale projects and perform hefty transactions. However, these companies are more likely to keep an eye on the valuations of their competitors so they can get a glimpse of how other businesses in the same sector are performing.

Moreover, their valuation will increase dramatically for startups witnessing spectacular growth within a few years since their inception. However, these cases are exceptions, so we cannot apply the same rule to all businesses.

Business Valuation Methods

The most straightforward way to evaluate a business is to subtract its liabilities from assets. However, this method provides a gloomy picture of a company’s net worth. For this purpose, business evaluators and analysts coined several different ways to offset this shortcoming.

Below we’ll walk you through some widely-used business valuation method that provides you meaningful insight into the company’s financial health.

- Book Value

One of the readily available methods for valuing a business is to look at its balance sheet and calculate the difference between assets and liabilities. Due to the simplicity of this method, it is often used by professional equity analysts and asset managers. Still, it is only valid for asset-heavy industries like refineries, oil and gas exploration and production, and fertilizers.

Upon calculating the book value of a specific company, you then have to eliminate all the intangible assets. Eventually, you’ll end up with a final figure that truly represents the tangible assets a company owns.

Many seasoned accountants and CA firms avoid using book value for corporate Valuation because companies tend to overstate or understate their assets and liabilities. It usually happens when a company files its tax returns, so in this case, they are more likely to overstate liabilities and understate assets.

Similarly, companies tend to overstate assets and understate liabilities to enjoy the highest valuation.

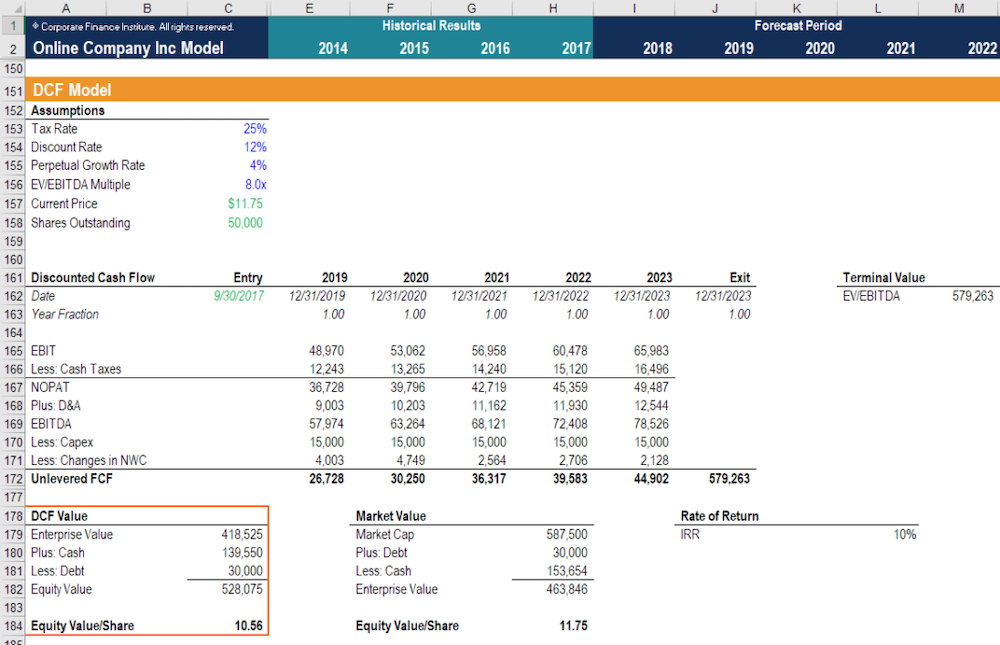

- Discounted Cash Flow

Another method for valuing a business is discounted cash flow. This method is deemed the golden standard of valuation. In the discounted cash flow method, the value of a company is determined based on the cash flow a company is expected to generate soon.

From the finance standpoint, discounted cash flow evaluates the present value of future cash flow. The method considers both the discount rate and the time of analysis.

Discounted Cash Flow =

Expected Cash Flow / (1 + Weighted Average Cost of Capital) * Numbers of Years in the future

With discounted cash flow, we can identify will the company be able to generate steady cash flow in the near future. However, this valuation method is not always accurate as it heavily relies on the projected revenue growth and the discount rate.

Both of these are exogenous factors that are often beyond the control of company management. So we have to be extra cautious while using this method for evaluating a specific corporate entity.

The DCF method is appropriate for those corporate entities whose profits are unlikely to remain stagnant in the near future.

The above examples depict how the DCF is used for business valuation.

3. Market Capitalization

Market capitalization is only used for public traded companies. All you have to do is multiply the company’s current share price by the total number of outstanding shares.

Market Capitalization = Share Price * Number of Outstanding Shares

One of the major drawbacks of market capitalization is that it is specific to publicly trade companies, while most companies raise capital by debt and equity.

Simply speaking, debt represents a company’s liabilities that have to be financed through the company’s profits. On the other hand, equity represents shareholders who buy a certain stake in a company as they foresee spectacular growth.

However, equity investors have the least preference than the lenders like bond investors and banks in case of the company file solvency.

4. EBITDA

While valuing a business, financial analysts don’t restrict themselves to the company’s net income and profitability. Accountants often manipulate these figures, so relying on them could be devastating for investors who intend to put their money in a high-growth company.

Secondly, some countries impose massive taxes on the businesses that compel the company to misreport their financial performance. In these countries, financial figures don’t reflect a real economic success of a company.

Lastly, net income is calculated by subtracting interest payments to the creditors from the gross income. It tells the evaluator how much a company relies on its capital structure. Keeping this consideration in mind, we only offset the potential threat of the wrong estimation of the company’s worth by looking at the EBITDA or an operating income.

In normal bookkeeping practice, if a company purchases land or a piece of machinery, its balance sheet doesn’t reflect that transaction all at once. Instead, the company divides the asset purchase price by its useful life and then records that expense as a depreciation every time.

Both amortization and depreciation are the same, but the former is used to report intellectual property rights and patents.

By simply manipulating the figures of amortization and depreciation, companies can make their financials look worse than bankrupt corporate entities. Tech conglomerates like Amazon and Tesla are more accustomed to this malpractice as they own gigantic factories and warehouses that depreciate over time.

With a solid understanding of how to determine the EBITDA (Earnings before Tax, Depreciation, and Amortization) for an individual company, it will be easy to identify had the accountants done any distortions while preparing the balance sheet.

5. ROI-Based Valuation

The ROI-based valuation considers the company’s profitability and how many returns investors could expect by investing in your business.

Let’s take a real-life example to widen our understanding of the valuation method. Suppose that you are diluting your equities to raise equity capital. In this case, investors first determine the value of 100% of a business.

If you are selling a 45% stake of your business at $150,000, investors will likely use the ROI-based valuation method to determine a real worth of a business. To calculate an accurate cost of a business, investors have to divide the amount you asked by the percentage you offered. So, in this case, your company’s worth will be $333,333.33.

In most cases, ROI-based valuation works because investors are always interested in knowing their expected returns before pouring money into the business.

With this method, you’ll need a lot of information and data to justify your figures to potential investors. Investors would like to know:

- How much time will it take to recover my 100% investment?

- Are the numbers you are presenting realistic, conservative, or optimistic

6.Asset-Based Valuation Method

Another effective name implies that this method determines the business’s net asset value and subtracts the value of its net liabilities using the data available on the balance sheet.

There are two main approaches to using the asset-based valuation method:

Growing Concern

Businesses that aim to pursue their operations without liquidating any of their assets should consider using a growing concern approach for asset-based valuation.

Liquidation Value

Conversely, the liquidation value approach is based on the assumption that owners no longer want to pursue their business and liquidate their assets. In such a scenario, the business valuation relies on the net cash that a company is expected to receive after selling assets.

With this approach, the valuation of a business will be relatively lower than the actual worth as the investor is foreseeing no future growth in the firm. However, the liquidation value approach can only be used in case of urgency when no alternative method exists to evaluate a business.

Conclusion

Business valuation is complex due to a different method, so it’s not easy to arrive at a fair value while evaluating a corporate entity.

It is pertinent to know that no specific approach to valuation is better than the other one. The best strategy for mitigating the potential threat of miscalculation during business valuation is to use different methods.

Lastly, suppose you want to conduct a valuation of a small company. In that case, we strongly recommend you to seek the help of experts as they could provide you with the most accurate and reasonable value of a company.